Units 11 and 12, Second Floor

Oxford and Glenhove

116 Oxford Road

Houghton Estate

Johannesburg, 2198

Mail us

info@apaa.co.za

Call us

010 443 7829

- HOME

- ABOUT US

- PRACTICE AREAS

- COMMERCIAL LAW (Agreements & Advisory)

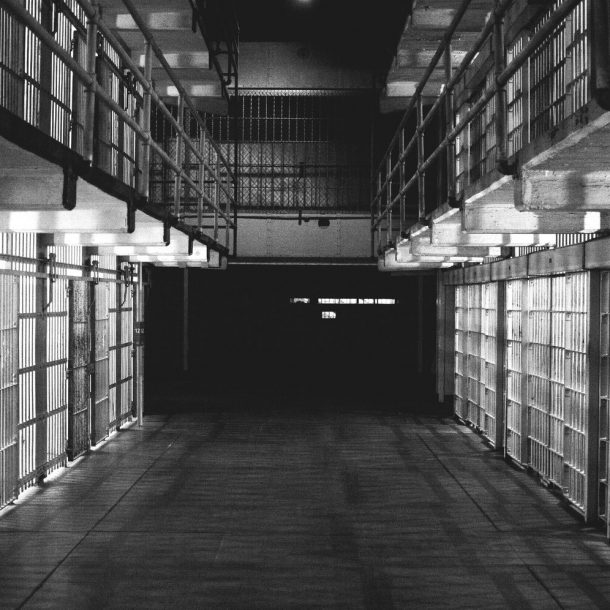

- LITIGATION (Civil & Criminal)

- ALTERNATE DISPUTE RESOLUTION (ADR) (Private And Commercial)

- CORPORATE LAW (Companies, Close Corporation, and other Juristic Entities)

- TRUST (Property) CONTROL AND REGULATION

- REGULATION AND COMPLIANCE

- LABOUR LAW (Employers / Private Individuals / Trade Unions / CCMA / Bargaining Council)

- FAMILY LAW (divorces / Children's Law / Domestic Violence / Protection Orders)

- INSURANCE LAW

- COMPETITION LAW

- MERGERS AND ACQUISITIONS (M&A)

- RESERVE BANK AND EXCHANGE CONTROL

- RECOVERIES AND FORENSICS

- INSOLVENCY LAW

- BUSINESS RESCUE AND SECTION 155 CREDITORS COMPROMISE

- BANKING & FINANCIAL SERVICES

- ENERGY LAW

- TELECOMMUNICATIONS LAW

- MINING LAW

- CONSTRUCTION LAW

- PROPERTY, REAL ESTATE LAW AND CONVEYANCING

- TAX AND OFFSHORE AFFAIRS LAW

- ESTATES

- CONVEYANCING

- COMPANY SECRETARIAL

- OUR TEAM

- AI

- POPI

- FICA

- VACANCIES

- IN THE NEWS

- CONTACT US